What is Fibonacci Retracement? Why is it the Secret Code of Trading?

Among the many technical analysis tools, Fibonacci retracement is undoubtedly one of the most mysterious and legendary. It originates from the mathematical laws of nature, visible everywhere from the spirals of a sunflower to the curves of a seashell, leading many to believe that this “natural code” can also reveal potential psychological turning points in financial markets.

However, is Fibonacci retracement a sophisticated instrument for gauging market psychology, or is it a self-fulfilling prophecy born from widespread belief? This question touches the core of technical analysis. This article aims to provide an exhaustive educational guide, stripping away its mysterious veneer. Starting from its mathematical roots, we will systematically explain its drawing methods, psychological interpretations, advanced applications, and crucial risk confirmation techniques. This article does not provide any investment advice but is dedicated to presenting an objective, comprehensive, and thought-provoking analytical framework.

The Origin of Fibonacci Retracement: From Nature’s Golden Ratio to Market Charts

To truly master Fibonacci retracement, one must trace it back to its source and understand the profound mathematical and aesthetic logic behind it. Its story begins in medieval Italy with a mathematician named Leonardo of Pisa, better known as Fibonacci. In his 1202 book “Liber Abaci,” he introduced a seemingly simple yet infinitely profound sequence to solve a hypothetical problem about the breeding speed of rabbits.

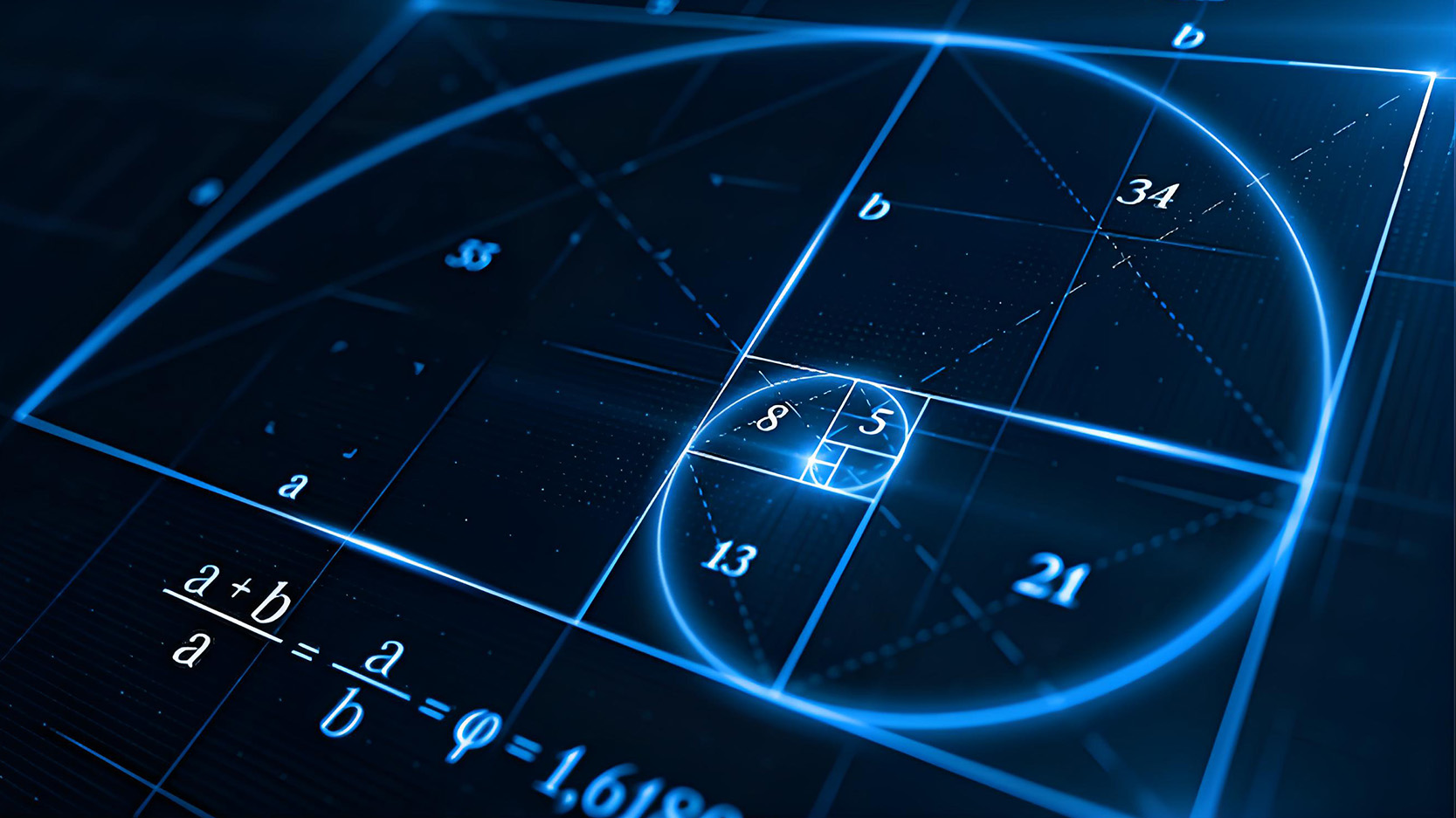

This sequence starts with 0 and 1, and each subsequent number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, … continuing to infinity. The recursive formula for this sequence is Fn = Fn-1 + Fn-2. However, the most fascinating aspect of the Fibonacci sequence is not the numbers themselves, but the hidden ratios between them.

As the sequence extends, a remarkable phenomenon appears: dividing any number by the next one yields a result that infinitely approaches a constant, approximately 0.618. Conversely, dividing any number by the preceding one results in a value that infinitely approaches 1.618. This irrational number, known as the “Golden Ratio” or the Greek letter φ (Phi), has been considered since ancient times to be the most harmonious and perfect proportion in nature and art. From the architecture of the Parthenon in ancient Greece to the arrangement of sunflower seeds and the length ratio of the human forearm to the hand, the Golden Ratio is ubiquitous, as if it were a universal design blueprint.

It is this universality that inspired technical analysts to apply it to financial markets. They believed that since markets are driven by humans with collective psychology, price fluctuations might also follow this “natural law.” The key trading ratios in the Fibonacci retracement tool are derived from this sequence:

- 0.618 (61.8%): This is the core Golden Ratio, obtained by dividing a number in the sequence by the one that follows it (e.g., 55 ÷ 89 ≈ 0.618). It is considered the most important retracement level.

- 0.382 (38.2%): This ratio is derived by dividing a number in the sequence by the number two places after it (e.g., 34 ÷ 89 ≈ 0.382). It represents a shallower retracement depth.

- 0.236 (23.6%): This ratio is obtained by dividing a number in the sequence by the number three places after it (e.g., 21 ÷ 89 ≈ 0.236). It typically marks a very shallow retracement in a very strong trend.

Interestingly, the Fibonacci retracement tool also includes two widely used levels that are not directly derived in the above manner. The 50% level is not a true Fibonacci ratio, but because it represents the exact midpoint of a price move and is a psychologically significant point of equilibrium, traders have incorporated it as an important reference level. Similarly, the 78.6% level is also popular among traders. It is not derived from dividing numbers in the sequence but is the square root of 0.618, representing a very deep retracement area.

This inclusion of non-Fibonacci numbers reveals a fundamental characteristic of technical analysis: it is a pragmatic art rather than a rigid mathematical dogma. Traders found in practice that prices often react at the halfway point of a retracement and thus integrated this observation into their existing tools. This shows that while technical analysts draw inspiration from mathematics, they ultimately adjust and optimize their tools based on empirical observations of market behavior. This flexibility and practicality are key to the survival and evolution of technical analysis in the ever-changing market.

How to Accurately Draw Fibonacci Retracement Lines on a Chart?

Moving from theory to practice, accurately drawing Fibonacci retracement lines on a chart is the first and most critical step in applying this tool. Its accuracy depends entirely on correctly identifying the price swing to be measured.

Identifying Key Swing Highs and Swing Lows

The foundation of Fibonacci analysis lies in the selection of a Swing High and a Swing Low. The subjective nature of this step is one of the most common criticisms of the tool, so establishing a set of objective identification rules is crucial.

A standard Swing High (SH) can be defined as a price peak where the high of the candlesticks on both its left and right sides are lower than its own. This means the price made a clear turn downwards after reaching this point. Conversely, a standard Swing Low (SL) is a price trough where the low of the candlesticks on both sides are higher than its own, indicating the price bottomed out and rebounded here.

Related Reading: What is a Candlestick? How to Read the Market’s Secrets?

When applying the Fibonacci tool, traders need to look for significant or major swing highs and lows that define a primary trend, not minor fluctuations in the market. An effective swing should be a complete move that is clearly visible to the naked eye and represents the market’s primary directional momentum over a period of time.

Drawing Methods in Uptrends and Downtrends

Once the key swing is identified, the drawing method is quite straightforward and just needs to be applied according to the trend direction. Fortunately, modern trading platforms, including those from brokers partnered with Cashback Island, have built-in Fibonacci tools that automatically calculate and draw all the levels once two points are selected.

- Uptrend: In a clear uptrend, a trader needs to find the starting point of the trend, which is a significant swing low, and anchor the Fibonacci tool’s starting point there. Then, drag the end point of the tool to the end of the uptrend, which is a significant swing high. After drawing, the platform will automatically generate a series of horizontal lines below the swing high. These lines constitute potential Support Zones for when the price retraces.

- Downtrend: In a clear downtrend, the operation is the opposite. A trader must first find the start of the trend, a significant swing high, and anchor the tool’s starting point there. Then, drag the end point to the end of the downtrend, a significant swing low. Once completed, a series of horizontal lines will appear above the swing low, forming potential Resistance Zones for when the price bounces.

If a trader repeatedly hesitates and struggles to find a clear, representative swing on the chart to measure, this itself is a strong signal: the current market may not be in a clear trend. Therefore, the difficulty of drawing the tool can be seen as a diagnostic indicator of the market state. Instead of “forcing” Fibonacci lines onto an ambiguous chart, a more professional approach is to recognize the lack of a trend and consider switching to a range-trading strategy or choosing to wait on the sidelines.

What Market Psychology Do Key Fibonacci Retracement Levels Represent?

Fibonacci retracement lines are not just cold mathematical ratios; they are thermometers of the market’s collective psychology. Each line depicts the ebb and flow of power between bulls and bears. Understanding the psychological meaning behind these levels is a key step from “knowing how to use” to “mastering” the tool.

Shallow Retracement (23.6%, 38.2%): A Sign of a Strong Trend

When the price, after a strong rally or decline, only retraces to the 23.6% or 38.2% level before resuming its original trend, it is an extremely strong signal that the current trend is very healthy and full of momentum.

From a market psychology perspective, this shallow retracement paints a picture of urgency and conviction. In an uptrend, it means that the selling pressure from profit-takers is very weak, while buyers who missed the first wave are filled with the anxiety of “missing out.” They are eager to enter the market at the slightest pullback, fearing they will miss the opportunity. This aggressive buying pressure quickly absorbs the weak selling pressure, pushing the price to new highs. This reflects a high degree of consensus and strong confidence among market participants in the continuation of the trend.

Midpoint and Golden Ratio (50%, 61.8%): The Key Battleground for Bulls and Bears

The area between 50% and 61.8% is often considered the most important battlefield in Fibonacci analysis, also known as the “Golden Zone”.

The 50% level represents a perfect point of equilibrium between the forces of the initial impulse wave and the subsequent corrective wave. A retracement to this level means that half of the initial trend’s momentum has been spent, and bulls and bears have reached a standoff, making it a highly significant psychological threshold.

The 61.8% level, the “Golden Ratio,” is even more significant. Due to its widespread fame among traders globally, this level attracts a massive amount of attention, including from many institutional investors. It acts like a global trading signal tower, where countless buy and sell orders are preset and triggered, making it a natural price inflection point with a powerful gravitational pull.

The market psychology in this zone is an intense “tug-of-war.” The power of the initial trend has weakened significantly, while opposing forces gather here. If the price can find support (in an uptrend) or resistance (in a downtrend) in this area and successfully reverse, it means the dominant side of the trend has successfully defended its position and regained control of the market. Conversely, if the price decisively breaks through this key zone, it usually indicates that a fundamental shift in the market’s balance of power has occurred, and the original trend may be over.

Deep Retracement (78.6%): The Last Line of Defense for Trend Continuation

When the price retraces to the deep level of 78.6%, it indicates that the original trend is very fragile and on the verge of failure.

This level is the “last line of defense” for whether the trend can continue. From a psychological standpoint, such a deep retracement has eroded the confidence of most early trend followers, and many may have already exited with a stop loss. Although a bounce from this level could still save the trend, the probability of success is greatly reduced. Once this level is broken, and the price further breaches the 100% level (the starting point of the initial swing), it can be concluded with a fair degree of certainty that the original trend has officially ended, and a market reversal has occurred.

How to Enhance the Reliability of Analysis with Fibonacci Retracement?

While powerful, the biggest weakness of Fibonacci retracement is that it can generate many false signals when used in isolation. Professional traders never rely on a single indicator; instead, they build a multi-dimensional analytical framework to improve the reliability of their decisions. The core idea is to look for multiple, uncorrelated technical signals pointing in the same direction in the same price area, which greatly increases the probability of a successful trade.

Finding “Confluence Zones”: Combining with Moving Averages and Trend Lines

The primary method for enhancing the credibility of Fibonacci analysis is to look for a “Confluence Zone”. Confluence occurs when multiple independent technical analysis elements intersect at the same location on the chart, thereby forming an extremely important price level that is validated by multiple factors.

A typical confluence scenario is when a key Fibonacci retracement level coincides with an important Moving Average (MA). For example, in an uptrend, the price retraces to the 61.8% Golden Ratio support level, and at the same time, the widely-watched 200-day moving average is also at the same price level. The strength of this support point, formed by both Fibonacci and the moving average, is far greater than that of any single element. Similarly, if a Fibonacci level coincides with a long-term effective trend line or a historical horizontal support/resistance level that has been tested multiple times, the importance of that area is also significantly amplified.

Related Reading: What is a Moving Average? How Does It Reveal Market Trends?

Confirming Momentum: Pairing with RSI and MACD Indicators

Fibonacci levels tell us where the price might turn, while momentum indicators can help us determine if the price is actually turning. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are two powerful tools for confirming changes in momentum. Among these, RSI Divergence is an extremely powerful confirmation signal. Take a retracement in an uptrend as an example: the price falls and makes a new low, just touching a Fibonacci support level.

However, at the same time, the RSI indicator below the chart fails to make a new low, instead forming a higher low than the previous one. This phenomenon where “price makes a new low, but the indicator does not” is called Bullish Divergence. It clearly indicates that although the price is still falling, the underlying downward momentum is exhausted, and market power is quietly shifting from sellers to buyers. A bullish divergence occurring at a key Fibonacci support level is a very high-quality signal that the trend is about to reverse.

Reading the Language of Candlesticks: Look for Reversal Patterns at Fibonacci Levels

If Fibonacci levels are the map of the battlefield and momentum indicators are the intelligence reports, then Candlestick Patterns are the command to sound the charge. They provide the most direct evidence of the real-time price reaction at key levels.

When the price reaches an important Fibonacci retracement level, traders should closely observe the candlestick formations. If classic reversal candlestick patterns appear here, such as a Hammer with a long lower shadow, a Doji indicating indecision between bulls and bears, or an Engulfing Pattern where one candlestick completely envelops the previous one, these are all intuitive manifestations of a reversal in market psychology at a critical point. A bullish engulfing pattern forming at the 61.8% Golden Ratio support level provides a much more reliable buy signal than the price simply touching the level.

This method of combining multiple confirmation techniques allows for the construction of a structured, logically rigorous trading decision-making process, effectively reducing the risk of emotional trading. This process can be summarized in a three-step framework:

- Map: Fibonacci retracement levels provide traders with a “map” of the market, identifying potential, high-probability reaction zones. As the price approaches these levels, traders become more alert.

- Context: Traders then look for “contextual” support. Does this Fibonacci level form a confluence with a moving average or trend line? Do momentum indicators like RSI or MACD show divergence signals? These contextual factors provide a deeper rationale for a potential trade.

- Trigger: Finally, traders wait for a clear “trigger.” This is usually a real-time price action signal, such as a confirmatory reversal candlestick pattern. Only when the trigger appears does the trader execute the trade.

This framework transforms trading from a gamble based on intuition into a rigorous process based on evidence gathering. It forces traders to be patient and disciplined, establishing a clear logical basis for every trade, which is crucial for post-trade analysis and continuous improvement.

Beyond Retracement: How to Use Fibonacci Extensions to Set Profit Targets?

A complete trading plan includes not only when to enter but also must specify when to exit. If Fibonacci retracement primarily addresses the question of “where to look for entry opportunities,” then its sibling tool—Fibonacci Extension—perfectly answers the question of “where to set profit targets.”

Fibonacci Extensions, sometimes called Fibonacci Projections, have the core purpose of predicting how far the next impulse wave might travel after the price completes its retracement and resumes the original trend. It projects into the unknown territory beyond the initial swing, providing a mathematical basis for setting reasonable take-profit points.

Unlike retracement levels, which are between 0% and 100%, extension levels are typically ratios greater than 100%, with the most common ones being 127.2%, 161.8%, 261.8%, and 423.6%. Among these, 161.8%, as an extension of the Golden Ratio, is considered an extremely important potential target level.

Drawing Fibonacci extensions usually requires selecting three points:

- The starting point of the initial trend swing (e.g., the swing low of an uptrend).

- The ending point of the initial trend swing (e.g., the swing high of an uptrend).

- The ending point of the retracement swing (e.g., the low point at the end of the retracement).

Through these three points, the trading platform can calculate and project a series of potential price targets. This enables traders to build a complete trading loop: look for entry signals at key Fibonacci retracement levels, set a stop-loss beyond the next retracement level or the start of the swing, and then set profit targets (take-profit orders) in stages or all at once at key Fibonacci extension levels. This method helps ensure that trades have a favorable risk-reward ratio, which is a vital component of professional risk management.

To clearly distinguish between these two complementary but often confused tools, the following table provides a straightforward comparison:

| Feature | Fibonacci Retracement | Fibonacci Extension |

| Primary Purpose | Identify potential retracement/reversal zones for trade entry. | Project potential price targets for trade exit (profit-taking). |

| Key Levels | Inside the initial swing: 23.6%, 38.2%, 50%, 61.8%, 78.6%. | Outside the initial swing: 127.2%, 161.8%, 261.8%, 423.6%. |

| Market Phase | Analyzes the corrective/retracement phase within a primary trend. | Projects the next impulse wave in the direction of the primary trend. |

| Drawing Points | Two points: from a swing high to a swing low (or vice versa). | Three points: from the start of a swing to the end of the swing, then to the end of the retracement. |

Exploring Advanced Applications of Fibonacci Retracement

The influence of the Fibonacci sequence extends far beyond retracements and extensions. It acts like the “genetic code” of technical analysis, forming the mathematical foundation for many more complex and sophisticated analytical theories.

Fibonacci Clusters: Superimposing Signals from Multiple Swings

This is an advanced technique aimed at finding the strongest support and resistance zones. The method involves drawing multiple sets of Fibonacci retracements on the same chart, targeting price swings from different timeframes or of varying significance. For example, a trader might draw a retracement for a long-term weekly swing and another for a more recent daily swing simultaneously.

A Fibonacci Cluster refers to a very narrow price range where levels from different Fibonacci studies overlap and converge. When a 38.2% level from a long-term retracement converges at nearly the same price point as a 61.8% level from a short-term retracement, the technical importance of that point is dramatically amplified. These cluster zones represent points of consensus among multiple market forces and often become extremely strong support or resistance levels, making them potential turning points that traders watch closely.

Fibonacci Time Zones: Predicting Turning Points in Time

Traditional Fibonacci analysis focuses mainly on the vertical price axis (Y-axis), whereas Fibonacci Time Zones take a unique approach by applying the Fibonacci sequence to the horizontal time axis (X-axis).

The basic idea is that market turning points may follow the Fibonacci sequence not only in price but also in time. To draw them, a trader first selects a significant market high or low as the starting point of the time series (bar 0), and then marks the positions of the 1st, 2nd, 3rd, 5th, 8th, 13th, 21st, 34th… bars along the time axis into the future. The theory suggests that the probability of the market turning is higher near these Fibonacci time nodes. Although this tool is not widely used due to its high subjectivity and uncertainty, it offers a unique perspective on “timing” in market analysis that is worth exploring.

Harmonic Patterns and Elliott Wave: The Geometry and Wave Structure of Fibonacci

Fibonacci ratios are the mathematical cornerstone of two major advanced technical analysis theories: Harmonic Patterns and the Elliott Wave Theory.

- Harmonic Patterns: Complex geometric patterns such as the Gartley pattern, Butterfly pattern, and Bat pattern are not defined arbitrarily but by strict Fibonacci ratios. Taking the classic Gartley pattern as an example, the formation of its bullish version must meet the following conditions: the retracement at point B should be close to 61.8% of the XA leg; the final retracement at point D should be close to 78.6% of the XA leg; and the CD leg is typically a 127% or 161.8% extension of the BC leg. These precise Fibonacci ratios form the “DNA” of harmonic patterns, giving them their identifiable and predictive qualities.

- Elliott Wave Theory: The relationship between this theory and Fibonacci is even more profound. Firstly, the basic structure of the waves themselves is based on Fibonacci numbers. A complete cycle consists of 5 Impulse Waves and 3 Corrective Waves, totaling 8 waves; 5, 3, and 8 are all numbers in the Fibonacci sequence. Secondly, the magnitude relationships between the various waves also commonly adhere to Fibonacci ratios. It can be said that Fibonacci ratios are the key to unlocking the structure of Elliott waves.

Myths and Limitations of Fibonacci Retracement: What to Be Aware Of?

No technical analysis tool is infallible, and Fibonacci retracement is no exception. The following will uncover its inherent limitations and common misconceptions to help traders develop an objective and critical understanding.

- The Subjectivity Challenge: This is the most fundamental limitation of Fibonacci retracement. The selection of swing high and low points is highly subjective. Two traders looking at the same chart may draw completely different Fibonacci levels because they chose different starting and ending points for the swing. This lack of a single objective standard makes the analysis results difficult to standardize and replicate, and it is one of the main reasons for criticism from the academic community.

- The Self-Fulfilling Prophecy Debate: Are Fibonacci levels effective because the market contains some mysterious natural law, or simply because enough traders believe in them and act accordingly? The latter view, the “self-fulfilling prophecy,” argues that when thousands of traders worldwide are watching the 61.8% Golden Ratio and placing a large number of buy or sell orders there, the price will naturally have a strong reaction when it reaches that level. From this perspective, the magic of Fibonacci comes not from the market itself, but from the collective belief of its participants.

- Context is King: It must be emphasized that Fibonacci retracement is a Trend-Following Tool. It was designed to measure pullbacks within a trend. Therefore, in directionless, consolidating, or sideways markets, its effectiveness is greatly reduced. In such market conditions, price movements lack clear impulse waves to measure, and forcing the application of the Fibonacci tool will only lead to confusion and false signals.

- The Danger of Isolation: This is the most common mistake made by novices. It must be remembered that Fibonacci levels are “potential reaction zones,” not absolute buy or sell signals. Blindly entering a trade simply because the price has touched a certain Fibonacci level is a very low-probability trading strategy. The professional approach is to use it as an alert system, prompting traders to pay close attention to the market in key areas and to look for other confirmation signals, as mentioned earlier, to validate a trading opportunity.

- The Backtesting Dilemma: From a rigorous quantitative perspective, the inherent subjectivity of Fibonacci analysis makes it difficult to design fully objective, rules-based backtesting programs. This has led to relatively few academic studies on its effectiveness, with inconsistent conclusions. While some research suggests it can be effective under certain conditions, its use by many traders is based more on empirical observation and practical experience than on rigorous statistical proof.

Conclusion: Integrating Fibonacci Retracement into Your Trading Analysis System

Fibonacci retracement is not a “crystal ball” that can predict the future, but rather a powerful probability map. It identifies the key areas where the market is most likely to pause, battle, or even reverse during a trend. Its power lies not in providing definitive answers, but in offering a structured analytical framework for chaotic price movements, helping traders identify high-probability trading opportunities in a highly uncertain environment.

The true professional path is not to blindly trust any single tool in isolation, but to integrate it into a larger, more robust, and comprehensive analysis system. For traders dedicated to building such a professional trading system, a partner that can provide all-around support is crucial. Cashback Island was created for this purpose. It not only directly reduces your trading costs and increases your net profit margin through trading rebates but also offers a suite of professional calculation tools to simplify your analysis process and helps you make smarter decisions with real-time market intelligence. On your journey to refining your trading skills and exploring market patterns, Cashback Island is committed to being your most reliable support, backing every step of your trading journey.

Cashback Island continuously updates its trading educational resources. Traders can visit the “Cashback Island Educational Guides” section to master more forex knowledge and investment skills.

Frequently Asked Questions

Q1. What is Fibonacci Retracement?

Fibonacci retracement is a technical analysis tool based on the Golden Ratio (such as 23.6%, 38.2%, 61.8%) used to predict support and resistance levels during a price pullback, helping traders identify potential turning points.

Q2. Is Fibonacci Retracement applicable to all financial markets?

This tool can be applied to trending markets such as forex, stocks, and cryptocurrencies. However, it’s important to note that sudden events can cause the ratios to fail. It is recommended to use it in conjunction with other indicators for comprehensive analysis.

“Trading in financial derivatives carries a high level of risk and may result in the loss of funds. The content of this article is for informational purposes only and does not constitute any investment advice. Please make decisions carefully based on your personal financial situation. Cashback Island assumes no responsibility for any trading derivatives.”

Related Articles

-

The flames of the U.S.-China trade war continue to burn. As the United States once again wields the tariff weapon, even including Hong Kong in the taxation scope for the first time, alarm bells in the global financial markets are ringing again. This is not just a power struggle between...2025 年 10 月 11 日

-

In the fast-paced forex market, the cost of every trade slowly eats away at your profits like a frog in boiling water. Many traders focus on finding the perfect entry point but overlook the most fundamental cost—the 'spread.' Choosing a high-quality low spread broker is the most significant difference between...2025 年 10 月 11 日

-

Want to use the credit card miles accumulated from your spending to travel the world, but always find the system confusing? You see others easily redeeming business class tickets, while your own air miles seem to devalue or expire without you noticing. Don't worry, you're not alone. This article is...2025 年 10 月 11 日